Toronto, ON — When 27-year-old Michael Landry quietly quit his job at a downtown fintech firm in early 2023, no one expected that less than a year later, he’d be at the center of a growing financial controversy.

His creation? A simple browser-based platform that helps everyday Canadians automate one of the most lucrative side strategies the country has seen in recent years.

“I didn’t reinvent the wheel,” Michael says. “I just automated a loophole that was hiding in plain sight.”

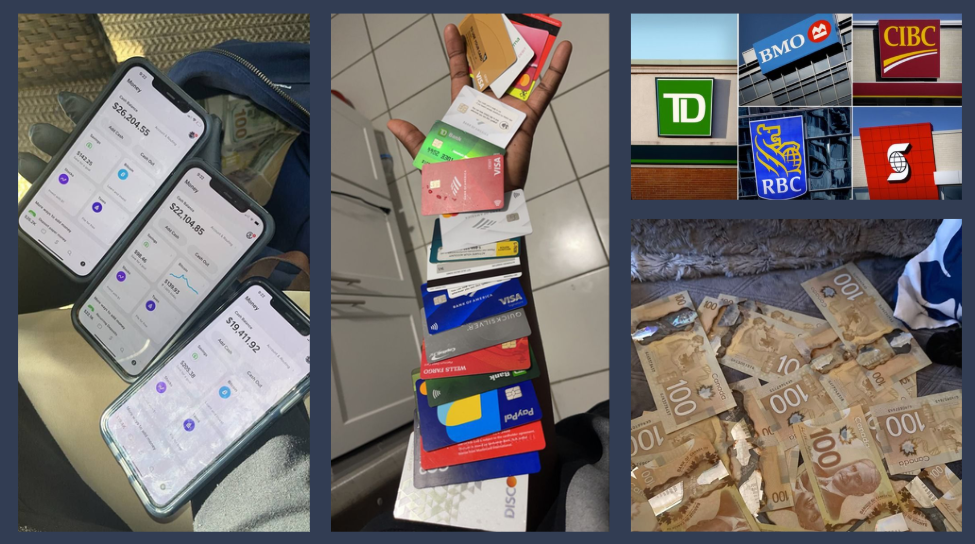

💸 “They called it legal… until it got too big”

At first, only close friends were using the platform. But after one Reddit post source went viral, thousands of Canadians rushed to try it. The tool was praised for its ease of use, transparency, and daily results.

By February 2024, over 9,300 users had signed up.

But that’s when the problems started.

“Three banks suddenly froze my account without warning,” says Michael.

“I had to fight to even get access to my own money.”

Legal experts say the strategy is completely within current regulations, but because it bypasses traditional financial institutions, it raises flags for compliance departments.

📄 Related: Why Canadians Are Quietly Ditching Traditional Banking

🤖 What the tool actually does

While Michael won’t reveal the full technical details, insiders familiar with the system say it uses a mix of:

- Automated indexing of open financial data

- Real-time opportunity scanning

- P2P distributed architecture

- A UI “so simple your grandmother could use it”

“It’s basically a layer on top of what already exists,” says an anonymous beta tester.

“But it removes the noise, and lets you move way faster than banks want you to.”

The platform requires no investment background, no selling, and no ads.

And it’s not a trading bot — at least not in the way people think.

It’s more like a “financial accelerator” for the independent age.

📉 Banks are worried. Users are celebrating.

Canadian banks haven’t made public statements, but two anonymous insiders from TD and RBC confirmed they are “monitoring the situation closely”.

Meanwhile, users claim the tool has helped them generate $200 to $700 daily, without needing any employees, inventory or ad budget.

“It’s like getting paid to be early,” one user wrote on PersonalFinanceCanada.

✅ Is it legal?

For now, yes.

Experts compare it to the early days of digital banking: uncomfortable for the old system, but not illegal.

Lawyers interviewed by The Globe and Mail noted that unless regulators step in, the platform operates in a gray-but-legal area that may soon become mainstream.

🔗 How to access it

Due to high demand and server load, the platform is currently by invite only.

But you can see the explainer page here → [click to access].

💬 “You don’t need a degree, you don’t need followers, you don’t need permission.”

— Michael Landry

🛑 Final note

This may not last forever.

As user numbers grow, and banks start to respond, the current “open window” might close.

If you’re reading this, you’re still early.

👉 Read how it works — and why Canadians are rushing in